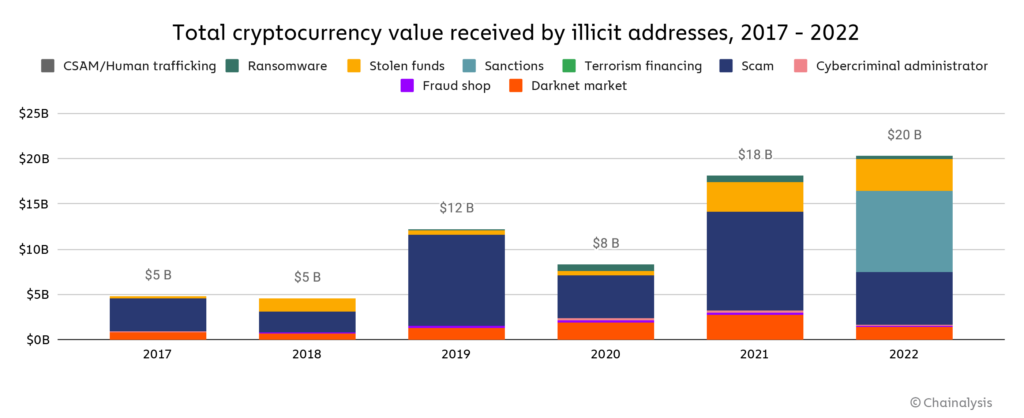

It shouldn't come as a surprise to many, but illicit cryptocurrency transactions hit an all-time high in 2022, totaling $20.1 billion, according to a report by Chainalysis.

Despite the massive downturn for crypto in 2022, illicit transaction volume rose for a second year in a row. Chainalysis notes that the $20.1 billion number is a "lower bound estimate," meaning the number is much higher in reality.

In 2021, the company found $14 billion in illicit activity, but it has since raised that number to $18 billion due to the discovery of new crypto scams. With an initial finding of $20.1 billion this last year, what will the final number be?

The chart below shows the total crypto value received by illicit addresses:

One of the report's key findings is that 44% of the illicit transaction volume was associated with sanctioned entities, highlighting the growing challenge of enforcing crypto sanctions and the potential compliance risks for businesses that are subject to U.S. jurisdiction.

[RELATED: U.S. Treasury Sanctions Crypto Mixer Tornado Cash]

This is a fairly impressive statistic when considering the U.S. Office of Foreign Asset Controls (OFAC) launched some of its most ambitious crypto sanctions yet. Chainalysis discusses:

"Crypto exchange Garantex, which accounted for the majority of sanctions-related transaction volume last year, is a great example. OFAC sanctioned Garantex in April 2022, but as a Russia-based business, the exchange has been able to continue operating with impunity. Transactions associated with Garantex or any other sanctioned crypto service represent, at the very least, substantial compliance risk for businesses that are subject to U.S. jurisdiction, including fines and potential criminal charges."

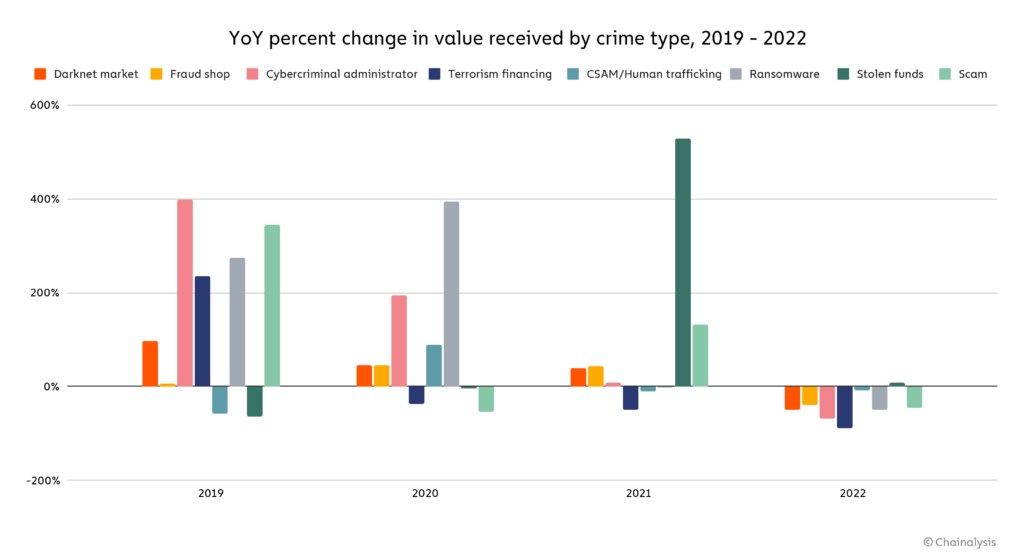

The report also notes that, with the exception of stolen funds, which rose 7% year-over-year, transaction volumes fell across all of the other more conventional categories of cryptocurrency-related crime. This suggests that the market downturn may be one reason for the increase in illicit activity. Basically, less money in the crypto market overall means less money associated with crypto crime. The graph below illustrates this:

However, the share of all crypto activity associated with illicit activity has risen for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022. But don't be fooled by this recent rise; it's a good thing that this number is still below 1%.

See the report from Chainalysis for more information.

Follow SecureWorld News for more stories related to cybersecurity.